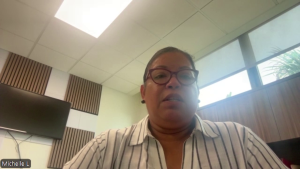

Starting this December, the Belize Tax Service Department is making a major shift; it’s going semi-autonomous. What does that mean for taxpayers and the way the department operates? Well, it’s all about boosting efficiency and accountability. But unlike a traditional government office, this new setup will be guided by an advisory board with more independence. News Five sat down with Director General Michelle Longsworth to break down what this transition really means and how it could reshape tax collection in the country.

Michelle Longsworth

Michelle Longsworth, Director General, Belize Tax Service

“So first off, the transition to a Semi-Autonomous Revenue Authority is another phase in the reform of the tax administration. You have seen over the past five years we have undertaken several reform initiatives to improve tax administration and moving to a semi-autonomous revenue authority is a very strategic decision aimed at strengthening our efficiency or accountability and the effectiveness of how we run our tax administration. So, it gives us more general autonomy as SARA operates with more independence than a traditional government department for faster decision making and improved financial and resource management and more flexibility in terms of staff processes and staff compensation and to enhance our efficiency and to continue to modernize our tax administration. So, basically that is why this is the next phase. This is nothing new. This is a part of the plan to continue the reform initiatives of the tax administration of Belize. Like many other countries, there are fifty other countries in the world. In the Caribbean you have countries like Jamaica, Barbados. In Latin America you have other countries in Africa and Asia. So, this is not just Belize. This is the best international practice.”

Facebook Comments