Tax Amnesty Program: “Formality Is Empowerment”

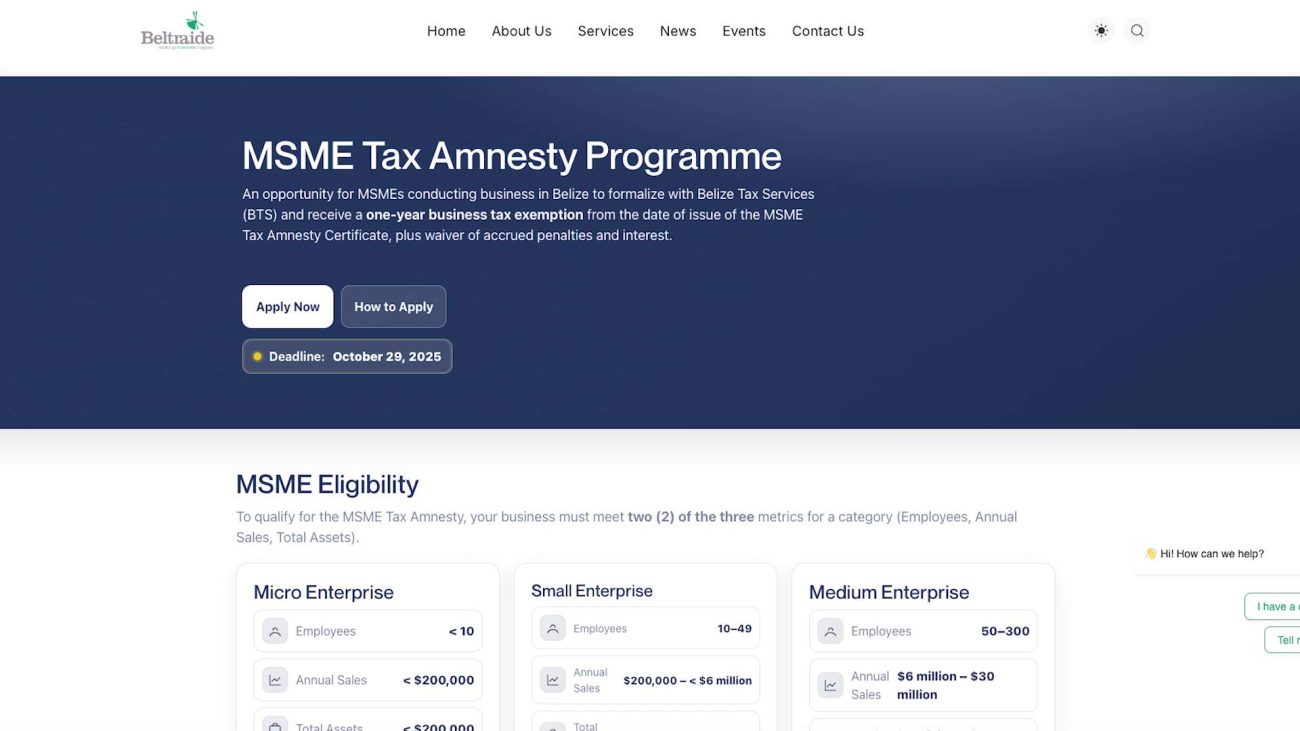

By the end of today’s tax conference, it was clear that the Tax Amnesty Program is about opening doors of opportunities, helping businesses grow, accessing finance, and getting government support. It is not simply about collecting taxes. With a clean tax slate, businesses can enter the formal economy and be eligible for duty exemptions, special one-off permits, procurement incentives, and more. All under the larger umbrella of the Fiscal Incentives Act. And for entrepreneurs operating in rural areas, help is finally within reach. This is how the initiative is being framed as part of a wider national strategy:

Lincoln Blake

Lincoln Blake, Director, Investment Policy and Compliance Unit

“Going into the Amnesty Program, the business tax amnesty program that we have, it’s, it’s one of several tools that we have in the Fiscal Incentive Act. One is the exemption of duties, which is one of the main tools that we have in the Fiscal Incentive Act. So that is a separate program from the amnesty. Then we have another one that is called ‘One off.’ So some companies might want to apply, and maybe they just have machinery that they need to import duty-free for them to start up. So they would be able to utilize that tool to apply and submit a request to import that specific item that they need. And there, and of course, you have the amnesty, and there’s also a procurement initiative as a tool to incentivize under the Fiscal Incentive Act. Now going back to the procedures of you applying, the idea behind it is to encourage a formalization. As I said, by an entity formalizing, it’s basically opening you up to several other forms of assistance. Not only access to financing, but also access to technical assistance that is offered by several institutions that we have established through various government agencies. If you’re interested in applying, we have an application form that you need to fill out, and that application form has several requirements, which is not long. Very basic. Alright? Because we need to know exactly who you are. We need to know what it is that you’re doing so that when you give your certificate, we can indicate there who the exemption is for and what activities you’re engaged with. And of course you also need to do certain things like the registration with the tax service and also registration of your business name, which you would need in most cases when you’re applying for a trade license. Of course, the trade licensing regime is also important, which in most municipalities we already have in place. And we also have the rural areas now will be eligible soon. To do all of this, we’re making it easy for you.”

Facebook Comments