Belize Jungle Retreat Turns Legal Battleground

Tonight, we’re taking you back to Burrell Boom Village for a fresh turn in the story of a partnership that started with big dreams but ended in bitter accusations. Get this: three American investors, led by Dr. Sade Thompson from California, team up with Belizean couple Kenny and Shanna Williams to create a jungle escape called Howler Jungle House and Cabanas. The plan was to build luxury cabins for travelers looking to experience Belize’s wild beauty. Sounds perfect, right? Well, not quite. After pouring in thousands of dollars to bring this vision to life, the relationship fell apart and now, fraud allegations are flying. What went wrong? Who’s telling the truth? We’re unpacking the promises made, the cash invested, and the fight that’s tearing this partnership apart. Here’s News Five’s Isani Cayetano with a follow-up.

Isani Cayetano, R eporting

eporting

When construction started on this Burrell Boom property owned by Kenny and Shanna Williams, Dr. Sade Thompson was told her two-bedroom unit would cost about eighty thousand U.S. dollars. But somewhere along the way, that price shot up, skyrocketing to one hundred and twenty-four thousand. That’s forty-four thousand dollars over budget. So, did Thompson and the other investors ever receive detailed invoices and proof of where their money went?

On the Phone: Dr. Sade Thompson, American Investor

On the Phone: Dr. Sade Thompson, American Investor

“We believed, like, this is what it would cost. They would give us an invoice, everything that we did, they gave us invoices that would break it down, the wood, the this… It looked very, very legit. And so, I thought, okay, and as I paying this, as I am paying the $124,000 [which] they said was going to be in phases, okay, phase one is thirty thousand US dollars… phase two… there were about five phases. And as we’re paying for these phases, there were other things coming up aside from the actual amount that we were supposed to pay.”

What specific upgrades justified these increases? Were there any audits or financial reviews conducted during the construction phase? Still, attorney Andrew Bennett, who represents the Williamses, argues that Thompson and her partners ended up with far more than they originally expected.

What specific upgrades justified these increases? Were there any audits or financial reviews conducted during the construction phase? Still, attorney Andrew Bennett, who represents the Williamses, argues that Thompson and her partners ended up with far more than they originally expected.

Andrew Bennett

Andrew Bennett, Attorney-at-law

“In our view, they got more than value for money. Look at this property, eco-friendly, untouched, natural setting, howler monkeys around. You don’t get that in America. You get that in Belize, and that is their capital injection. What Mr. Williams has done for them, at no cost, was to oversee the construction of these homes. So, talking about value for money, they have gotten more than. And that is a matter of dispute, so we will not get into the numbers.”

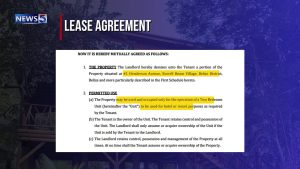

According to Thompson, they ended up paying rent and extra fees, plus meeting with contractors after costs kept climbing. Even though the price was higher than expected, they believed the luxury upgrades and promised returns would make it worthwhile, especially with a notarized agreement in place.

Dr. Sade Thompson

Dr. Sade Thompson

“We ended up paying rent, we ended up paying all these extra fees because they said that the people weren’t local. And so, I just kept on… We ended up going in person, so after we decided that we’ll pay the… we’ll do that amount, we met with the contractor, we had a Zoom meeting with the contractor. It was higher than we expected, but everything still sounded good. It was luxury so we’ll make our money back. They were telling us about returns on investments. And so, since they were doing an informal mortgage that, and we did see it, it was stamped and it was not stamp duty, but they did have like a notary do that agreement with them.”

At one point, Thompson and her partners realized they needed some expert guidance to keep the project on track. So, they brought in consultant Jazmynn Tillett to help steer the ship and figure out the next steps.

On the Phone: Jazmynn Tillett, Consultant

On the Phone: Jazmynn Tillett, Consultant

“You could have easily walked away from the situation safely, but you didn’t. Instead, you just became more greedy. You tried to ask them for more money rather than just saying, listen… All they had to do was just be accountable. For me, as a foreigner living here, too, it’s really sad to see people be ripped off over five hundred thousand dollars. The FIU has done nothing, the Ladyville police have not even allowed us on the property to do inventory and meanwhile on the cameras it’s seen that they are taking all their property. So we have these three cabanas that are being assessed by DFC at over half a million, or over a million dollars, and we can’t even get into them to simply put a camera or count how many dishes.”

Our investigation has raised some serious legal and ethical questions. Why did the Williamses maintain beneficial ownership while soliciting large investments? Does this raise questions about control and risk? Could the investors’ lack of familiarity with local business practices have contributed to misunderstandings? So, why were they kicked out?

Our investigation has raised some serious legal and ethical questions. Why did the Williamses maintain beneficial ownership while soliciting large investments? Does this raise questions about control and risk? Could the investors’ lack of familiarity with local business practices have contributed to misunderstandings? So, why were they kicked out?

Andrew Bennett

“There are two aspects of that. One: We have communicated to Courtenay Coye that the relationship between Jazmynn Tillett and my clients have soured and so she is no longer an invited person to be on this property. We have suggested that both parties work on appointing somebody who is amenable to both parties.”

We’ll continue to follow this story in our next newscast. Isani Cayetano for News Five.

Facebook Comments