Andrew Munnings Challenges $183K Tax Claim

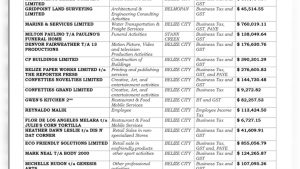

Taxes, they’re the talk of the town right now, and for good reason. Earlier this year, the Belize Tax Service dropped a bombshell list of people and businesses owing big bucks to the government. One name stood out: businessman Andrew Munnings, with a whopping one-hundred-and-eighty-three-thousand-dollar debt. Fast-forward two months, and the funeral director found himself behind bars for not paying up. He’s out now, but the big question remains, why was he the only one jailed? And what can you do to avoid the same fate? In this week’s Five Point Breakdown, Britney Gordon digs deeper.

Andrew Munnings

Britney Gordon, Reporting

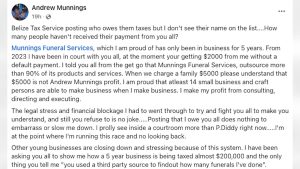

Back in June, funeral director Andrew Munnings found himself in the spotlight after the Belize Tax Service published a list of people with unpaid taxes. His name was right there, with a hefty figure of over one hundred and eighty-three thousand dollars. That list had amounts ranging from just six thousand dollars to a jaw-dropping eight million dollars. But Munnings didn’t stay silent. He stepped forward to say the number wasn’t entirely accurate and insisted he wasn’t trying to dodge his taxes.

The Belize Tax Service Says Pay Up

Andrew Munnings

Andrew Munnings, Businessman

“I could definitely tell you, Munnings don’t owe one hundred and eighty-three thousand dollars. The fact that the director came on news and said if it is that I am willing to work with the actual tax, which is somewhere around $seventy thousand dollars she’s willing to forgive the penalties and interest and everything. So when you do calculation one hundred and eighty-three thousand dollars you are looking at over a hundred thousand dollars just with penalties and injuries. So that is not an accurate. Amount at all. And when you look at that amount, it is back tax.”

On Monday, Munnings was taken to jail after the BTS accused him of defaulting on his payments. Although Munnings clarified that he was on a payment plan, he was still unable to meet the installments he was ordered to pay. Director General of the Belize Tax Service, Michelle Longsworth, explains how Andrew Munnings landed behind bars.

On Monday, Munnings was taken to jail after the BTS accused him of defaulting on his payments. Although Munnings clarified that he was on a payment plan, he was still unable to meet the installments he was ordered to pay. Director General of the Belize Tax Service, Michelle Longsworth, explains how Andrew Munnings landed behind bars.

What Happens if You Don’t Pay Taxes?

Michelle Longsworth

Michelle Longsworth, Director General, Belize Tax Service

“Once you default on your payment arrangements, we normally seek court’s assistant in having you pay your taxes. I believe in February of this year, we took him to court. And the court ordered him to two thousand a month. He also defaulted on that. He made two payments, I believe, and he defaulted on that. When that court order was made the magistrate made it clear to him that if he defaulted on those court payments, he would be committed to jail. He defaulted and as such yesterday the magistrate court issued a committal warrant and he was remanded to jail.”

It is the responsibility of every Belizean to pay their fair share of taxes, and the Belize Tax Service is responsible for ensuring that every citizen does so. However, some argue that the tax service has owed money to many Belizean citizens for years and have failed to pay up. So why should Belizeans bother to pay their taxes?

Where does Taxpayers money go?

Where does Taxpayers money go?

Michelle Longsworth

Michelle Longsworth

“The Belize Tax service responsibility is to ensure that all our taxpayers are treated fairly and that is very important for us. What happens here is that it is important for taxpayers to understand that we are here to collect taxes. That’s the operation of BTS. The taxes that we collect is what supports government’s social programs. It’s what supports education. It’s what supports health. It’s what support infrastructure. So collecting the revenue or collecting taxes is a core responsibility of every business owner or every Belizean because even you as an employee, I as an employee, we pay our taxes. On a regular basis, on a monthly basis, we don’t even see the taxes that come out of our salary.”

The Belize Tax Service says every business has to pay its fair share and that includes any side jobs outside your main hustle. But Andrew Munnings isn’t buying their math. He insists the figure they published is way off, arguing that the calculation doesn’t reflect changes he made to his business model during the COVID-19 pandemic.

The Belize Tax Service says every business has to pay its fair share and that includes any side jobs outside your main hustle. But Andrew Munnings isn’t buying their math. He insists the figure they published is way off, arguing that the calculation doesn’t reflect changes he made to his business model during the COVID-19 pandemic.

How Covid-19 Affected Tax Assessments

Andrew Munnings

“They times the smallest package at that time. By all of that, it didn’t even matter to them that during that time was a COVID time. The package that they use during COID, you couldn’t have been in church. You couldn’t, you didn’t need booklets. You didn’t need a whole leap of debt announcement and customized cascade and all of these stuff. So the package that they use, even if they are saying that they use a smallest package, so many items within that smallest package when I first came out wasn’t even needed because it was during COVID. So still your calculation is off. And we have been telling you, my accountant have been telling you guys are assessing me wrong.”

If a business consistently fails to pay its taxes, it will be taken to court. Following Munnings release, he has been ordered to use all money raised by his supporters to help pay off his owed taxes.

Orson “OJ” Elrington

Orson “OJ” Elrington, Attorney-at-law

“They also requested that Mr. Munnings also give a undertaking that all funds received as a result of the fundraising efforts wherever they may be, would be directly applied to what they say is the outstanding depth that he has to the tax department.”

But will it be enough? And how can the average Belizean avoid the same fate? Longsworth explains the step people can take to pay off their taxes.

What to do if you can’t pay taxes?

Michelle Longsworth

Michelle Longsworth

“We urge all taxpayers, especially young entrepreneurs, it’s important small businesses. It’s important to work with the Belize Tax Service as early as possible as soon as you become registered. Learn from us what your tax obligations are. We can advise you, Mr. Monning, refuse or taxpayer service education. Do not refuse that. That is an important part for you to learn what your tax obligation is. Take advantage of the support we provide. Also, take advantage of the flexible arrangement that is available to all taxpayers.”

The Belize Tax Service stated that other names featured on the list have made an effort to pay off their owed amounts and urges all members of the public to pay their taxes responsibly. Britney Gordon for News Five.

Facebook Comments