Belize Tax Services Calls Them Out, Business Owner Claps Back

The Belize Tax Service is turning up the heat, naming and shaming more than a dozen businesses for unpaid taxes in a bold public notice. But while the government is calling out defaulters, at least one business owner is calling foul. Andrew Munnings of Munnings Funeral Home says he’s already in court, making payments, and doing his part. So, why is he still being singled out? And beyond that, a bigger question is emerging: while the tax office demands what it’s owed, what about the refunds it owes to everyday Belizeans? Tonight, we take a closer look at the growing tension between taxpayers and tax collectors and ask, is the system fair for everyone? Here’s Paul Lopez with the following story.

Paul Lopez, Reporting

Paul Lopez, Reporting

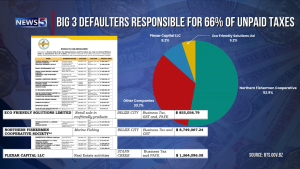

The Belize Tax Service has issued a public notice, putting more than a dozen businesses on blast for failing to pay their business taxes and GST. Among the biggest defaulters? Northern Fishermen Cooperative Society, Plexar Capital LLC, and Eco-Friendly Solutions Limited. According to Director General Michelle Longsworth, this isn’t just a warning, it’s the final call for those who’ve stayed silent on their tax debts. So, what happens next? And how serious is the crackdown?

Michelle Longsworth

Michelle Longsworth, Director General, Belize Tax Services

“What we are saying here is because all efforts have gone unresponsive by these tax payers. We have done everything to try and collect from them. It is important to know that none of these defaulters listed just received a bill out of nowhere with no warning. We tried working with them and we still continue to try but they refuse to engage in meaningful discourse. So, each one of them was afforded the rights all tax payers receive, audit reviews, payment arrangements, disputes if they wanted to dispute any of the assessment. They were engaged.”

Andrew Munnings, owner of Munnings Funeral Home, is firing back after his business appeared on the government’s tax defaulters list. The Belize Tax Service claims he owes one hundred and eighty-two thousand dollars in unpaid business tax and GST. But Munnings says he’s been in court over the issue and is making regular payments. In a social media post, he called the system unfair and said small businesses like his are being unfairly targeted.

On the Phone: Andrew Munnings, Founder, Munnings Funeral Home

On the Phone: Andrew Munnings, Founder, Munnings Funeral Home

“I have seen the inside of a courtroom more than P Diddy. When the director says these are business that are noncompliant that they will take to the court, I am like, what have I not been through with you all. I have an agreed court statement, where I am paying court fee and business tax and GST and back tax. I am paying them two thousand monthly. So what do you want. I have made it clear it is our duty to pay taxes. But let us clear, a five-year business with two hundred thousand dollars in back taxes is ridiculous to me.”

Director General Michelle Longsworth says the tax system relies on businesses to report their own earnings. She explained that under the law, it’s a system based on voluntary compliance, meaning the responsibility starts with the business, not the tax office.

Michelle Longsworth

“Remember for business taxes there are different rates, one point seven five percent, three percent, six percent, it depends on the sector that you are in, the type of business you own. For GST it is twelve percent across the board and that is different, because remember the confusion here at times is that GST is not a tax on business, it is consumer tax. Also, business tax is paid on your gross not your profit. There is this misconception that business tax is paid on your profit. That is so very wrong. It is on your gross. What we do when we do audits or validation, we validate that what you submit to us is correct.”

Andrew Munnings says when he first tried to register his business with the Belize Tax Service in 2021, he was told he didn’t meet the threshold. But after officially registering in 2023, he was hit with a large tax bill. Now, he’s challenging how that amount was calculated, arguing it doesn’t reflect how his business actually operates.

Andrew Munnings says when he first tried to register his business with the Belize Tax Service in 2021, he was told he didn’t meet the threshold. But after officially registering in 2023, he was hit with a large tax bill. Now, he’s challenging how that amount was calculated, arguing it doesn’t reflect how his business actually operates.

Andrew Munnings

“I am not saying we should not pay tax. That is our duty and responsibility. Nobody never told tax services we never want pay tax. It is how we go about doing stuff. The last time went to court they took me to court for the closure of my business for thirty days. I told them please close it down permanently, I am absolutely tired. I am not at a stretch point anymore with it, because I can see clearly that my business is not the only business going through all this. But, what I am trying to say if we give tax breaks to big people, people with big fancy names, why we cant give it to young, small, born Belizean people. My thing is that my name is on that list and I don’t feel ashamed about it, because I work hard for what I have and what I try give. I don’t want anybody to feel sorry for me. I don’t want nobody to fell sorry for me. I will pay my tax, whatever they say I owe. They are getting their two thousand monthly.”

The tax debate isn’t over just yet. Andrew Munnings, owner of Munnings Funeral Home, says he’ll keep paying the Belize Tax Service two thousand dollars a month, as ordered by the court, until his debt is cleared. But while his case continues, a new conversation is surfacing: what about the tax refunds the government owes to everyday Belizeans? That’s right, while some are being called out for what they owe, others are still waiting on what they’re owed.

The tax debate isn’t over just yet. Andrew Munnings, owner of Munnings Funeral Home, says he’ll keep paying the Belize Tax Service two thousand dollars a month, as ordered by the court, until his debt is cleared. But while his case continues, a new conversation is surfacing: what about the tax refunds the government owes to everyday Belizeans? That’s right, while some are being called out for what they owe, others are still waiting on what they’re owed.

Michelle Longsworth

“What I will say here is that I think that some people are being mischievous because we have a team of persons monitoring these comments on social media and then they try to contact them to get the information of their employment, they put out there we owe them from 2019, 2021 an when we try to contact these persons they get no response or they just block you because at the end of the day they have been mischievous. I can tell you that we have helped quite a few person who have genuinely posted out there and when we contact them they give their information and they can attest to the fact that they have been immediately paid their refund.”

Longsworth says a similar list of tax defaulters was published in 2023. Reporting for News Five, I am Paul Lopez.

Facebook Comments