Hydro Deal Adds to Debt; Gov’t Bets on Recovery Plan

Now, while the government’s discount on the hydro deal is making headlines, there’s another number you should pay attention to, Belize’s debt-to-GDP ratio. Prime Minister Briceño revealed today that this deal will bump that ratio up by four percent. But he’s telling the nation not to panic. Why? Because there’s a recovery plan in motion. In the short term, government will issue treasury notes, basically IOUs, to cover the cost. The Central Bank will need to come up with a hundred and twenty-two million dollars in foreign exchange to make it happen. So how does government plan to balance the books? PM Briceno says they’ll divest shares in the hydro plants to break even. It’s a calculated risk, and tonight, we’re asking, will it pay off?

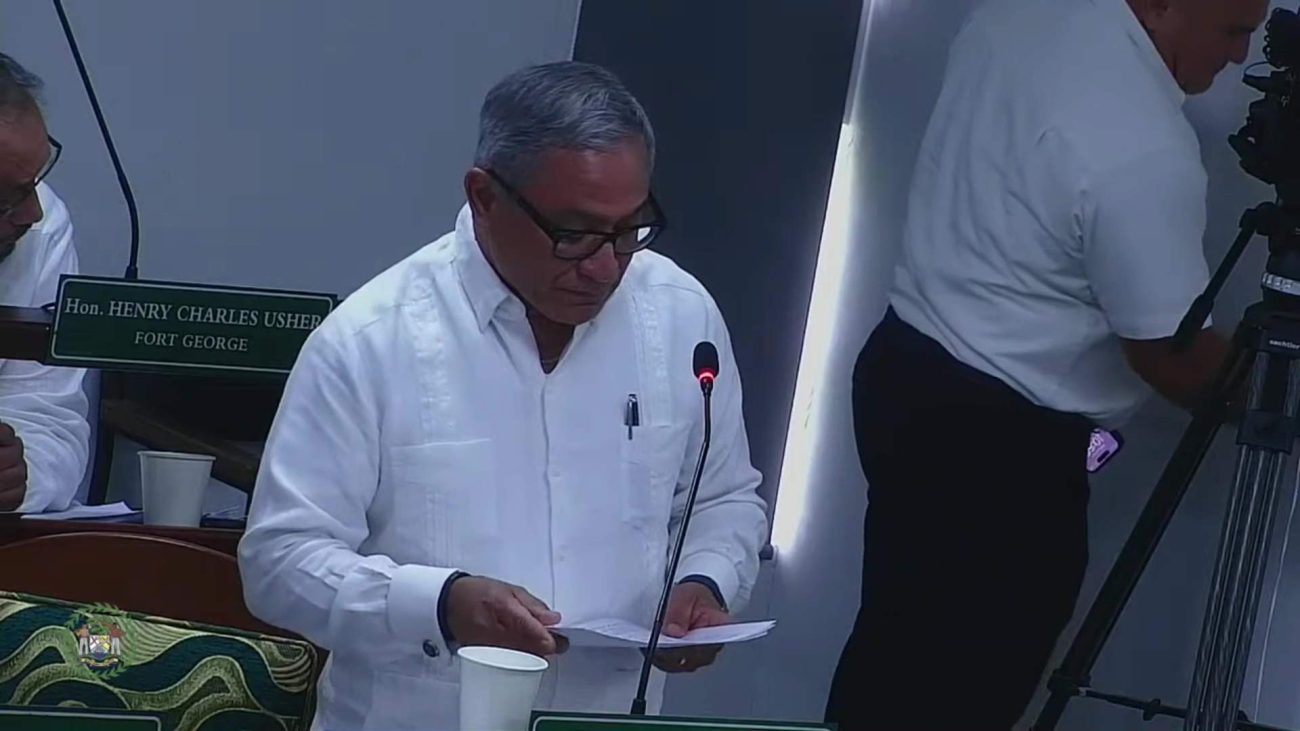

Prime Minister John Briceño

“I should underscore that this temporary increase in public debt is an increase in the domestic debt stock only. We are not borrowing from abroad. We nuh the borrow from private banks. We the borrow from our own local resources here in Belize. Moving forward government will seek to divest these shares in the hydro at a par. So we are not going to lose money. And in the instance of BEL at a margin that allows a gain for government. So the domestic public debt moves marginally, but temporarily for the purpose of a strategic national investment. Other domestic institutional investors have already expressed interest such as the HRCU, other credit unions and several of the insurance companies and probably even the banks. Divesting the hydro company shares to recoup government investments will be near term initiatives. On the other hand, the BEL shares may requires some time before reselling, perhaps to a strategic investor, given the recovery curve upon which BEL is currently embarked, principle due the increase power cost from CFE. We are confident that the price at which these shares can be sold will far exceed the one dollar and fifty cents per share at which the shares are now being purchased by government.”

The prime minister says, “we’re borrowing from our own local resources here in Belize”. We ask, are these funds guaranteed by government? Will this affect liquidity in the domestic financial system? The PM also says, quote, we are not going to lose money, end quote. Likewise, we ask, what guarantees, or contingency plans exist if market conditions change? Has government modeled worst-case scenarios, including drought, tariff shocks, or investor appetite drying up?

Facebook Comments