Magistrate Shuts Down Loan Suit Over “Unconscionable” Fees

Senior Magistrate Baja Shoman declared a loan agreement between Bathsheba Limited and Shermadine Dennison unenforceable, citing multiple violations of the Money Lenders Act and associated regulations.

The case, heard in full on June 27, 2025, centered around a $2000 loan issued to Dennison on November 4, 2024. Bathsheba Limited sought to recover $5517, which included interest, fees, and a $2000 recovery charge. However, the court found that the promissory note failed to meet legal standards.

“The promissory note AR3 does not state the effective annual interest rate on the loan. This omission contravenes the expressed requirements of the Legislation,” Magistrate Shoman wrote in her decision. “The court therefore deems that the promissory note is unenforceable and having considered all the issues above, finds that the suit is unenforceable.”

While the note listed a $78 interest charge, it did not specify the rate or whether it was continuous.

“It is not sufficient to place a blanket statement that other variable interest may be charged,” the Magistrate stated. “Any and all interest to be charged must be stated and made known to the borrower.”

The court also rejected Bathsheba’s claim for “permissible fees” of $320, noting that the promissory note did not define the nature or percentage of these fees. “The rate of the permissible fees being charged must be agreed upon and expressly stated in the promissory note,” Shoman ruled.

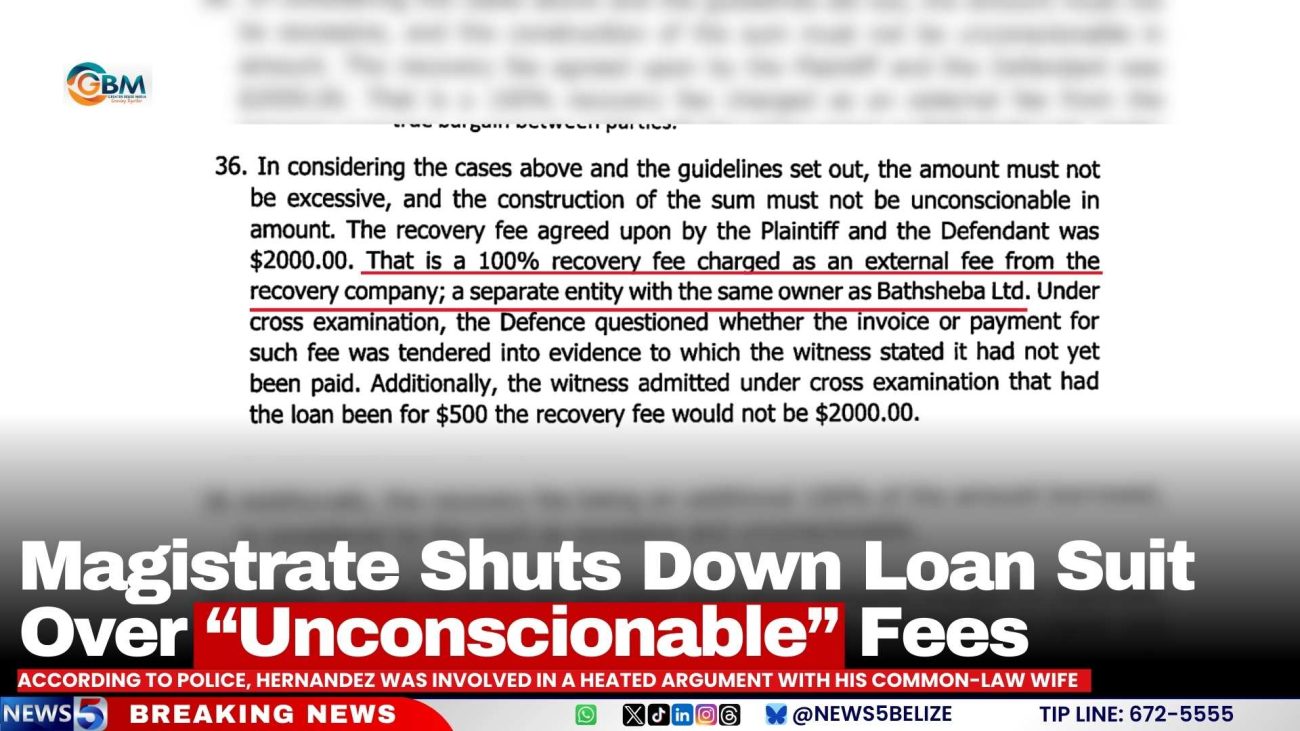

Perhaps most notably, the court struck down the $2000 recovery fee, which Bathsheba claimed was a fair administrative charge. The Magistrate found the fee to be “excessive and unconscionable,” especially given that it equaled the original loan amount.

“The recovery fee being an additional 100 percent of the amount borrowed is considered by the court as excessive and unconscionable,” Shoman wrote. “The amount must not be excessive, and the construction of the sum must not be unconscionable in amount.”

The ruling also addressed Bathsheba’s attempt to withdraw the case after submissions had been filed. The court refused the withdrawal, stating, “The matter is no longer in the hands of the plaintiff. The court has an obligation in the interest of justice to determine the matter.”

Dennison’s defense argued that the loan agreement violated several provisions of the Money Lenders Act, including sections 13 and 14, which govern enforceability and interest charges. The court agreed, concluding that the entire suit was invalid.

“Each party is to bear their own cost,” the Magistrate concluded.

Facebook Comments