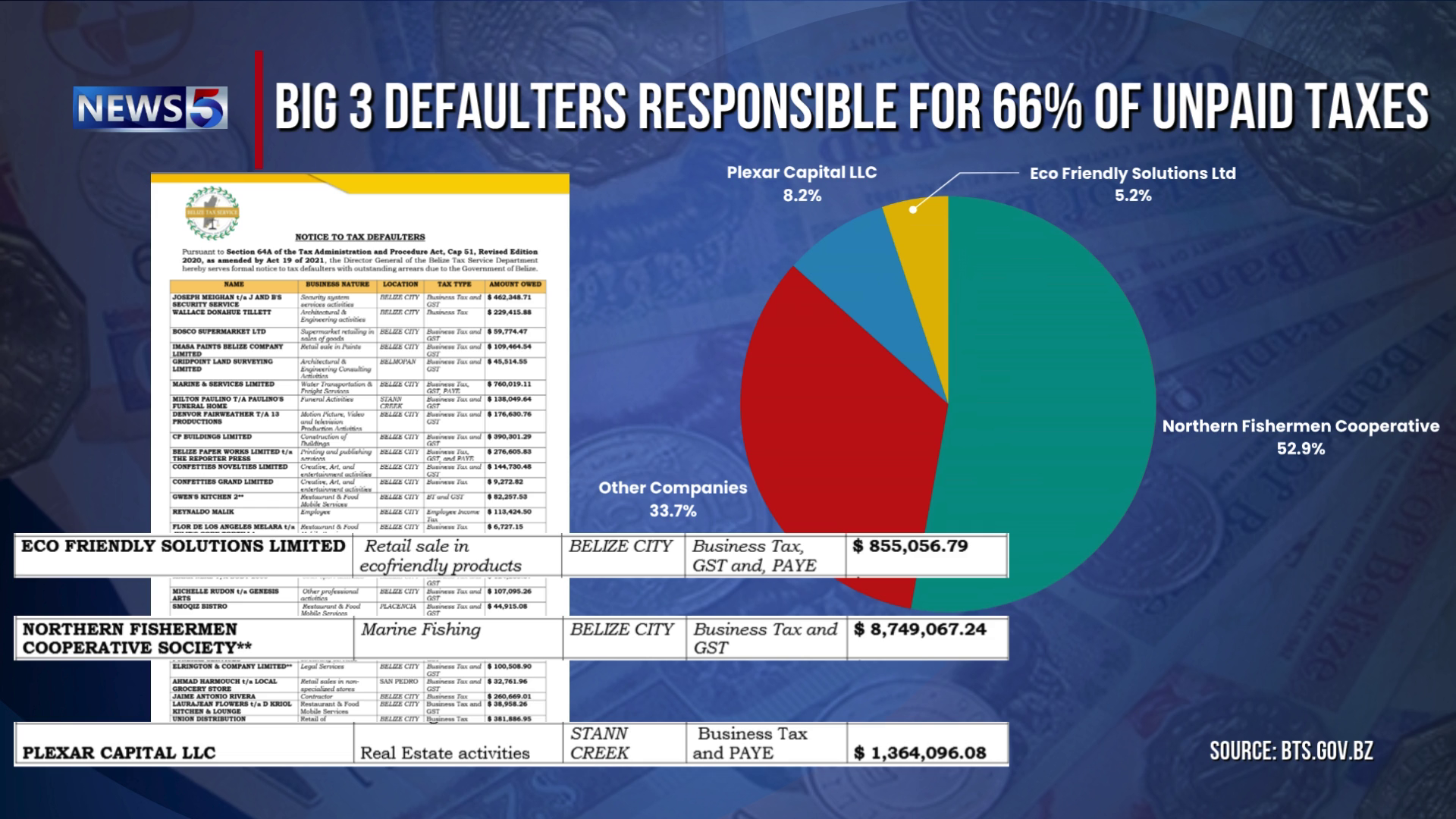

Tonight, we’re asking the tough questions about accountability and fairness in Belize’s tax system. Over sixteen million dollars in unpaid taxes—yes, sixteen million—is still sitting on the books, uncollected by the Government of Belize. And it’s not just any business. Among the top defaulters is the Northern Fishermen Cooperative Society, which recently had to be bailed out by the Holy Redeemer Credit Union. It still owes more than eight million dollars. The Belize Tax Service has now published a list of tax defaulters, including names like Plexar Capital, Eco Friendly Solutions Limited, and Marine & Service Limited. So, here’s the question: why are these debts still unpaid and what message does this send to everyday Belizeans who do pay their taxes? When the Holy Redeemer Credit Union held its annual general meeting a few weeks ago, the spotlight briefly turned to the Northern Fishermen Cooperative, a group recently bailed out by HRCU after facing serious financial trouble. But while the President of the Board addressed the situation, one major detail was left out: the Cooperative’s staggering eight-million-dollar tax debt to the Government of Belize.

Wendy Castillo, President, Board of Directors, HRCU

“With the Northern Fishermen [Cooperative Society’s] loan, like we explained to you earlier, Northern Fishermen had a facility with the Belize Bank. They also had a facility, meaning a loan, with HRCU. When the bank foreclosed or decided that will no longer give those privileges to Northern Fishermen, Northern Fishermen Cooperative, a sister cooperative to HRCU, approached us. What members must realize is that Northern Fishermen has been a member of HRCU. All the fishermen, most of them, have membership with us. They have never been delinquent with us, HRCU; they remain meeting their obligation to this day, so they approached HRCU to buy over those facilities. They are highly collateralized, meaning that they have a lot of assets more than what, combining the loan with the one they have at HRCU, would amount to. So, for us, the board, as by regulation, reached out to the registrar, who is the Central Bank, to say we want to take over the loan from Belize Bank and bring it to HRCU with the present loan they have. We consolidate it, bring it together, and so the registrar said, we will allow HRCU to do that but because of the portfolio, the amount, we want you to provision for it in full.”