Remittances to Belize Hit $173 Million

Many families across Latin America and the Caribbean (LAC) wait every month for money to be sent by relatives living abroad. That money is fuelling a historic growth in Central America, with overall remittances at record highs.

These family-to-family transfers pay for food, rent, school fees, medical bills and more for many households in the home country.

The Inter-American Development Bank (IDB) now reports that in 2025 these flows have reached a new record.

“Remittance flows remain an essential component of the regional economy, demonstrating notable resilience in the face of uncertainty,” IDB reported. “This resilience cannot be assumed to be unlimited: in many countries within the region, potential declines in migration flows or increased barriers to sending remittances could significantly impact household income and consumption.”

However, the rise comes in a year marked by uncertainty in the United States, where approximately 50,000 Belizean migrants live and work.

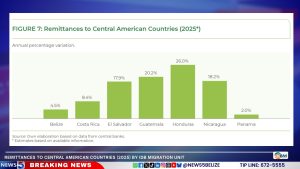

Remittances to Central American Countries (2025) by IDB Migration Unit

What has happened?

Despite global uncertainty, IDB reports that remittances to Latin America and the Caribbean (LAC) are expected to total 174.4 billion US dollars by the end of 2025. This marks 16 years of uninterrupted growth.

Migrants continue to support their families despite economic and political uncertainty in host countries. The figures show that money sent home by migrants remains one of the strongest financial lifelines for families in the region.

Belize is part of this trend.

Although Belize has a smaller economy, remittances are rising again in 2025 and also remain central to household income. The IDB reports that Belize has received approximately 173 million US dollars in remittances so far this year. The United States is the main source, accounting for 84.1% of all transfers.

This flow reflects 5.2% of Belize’s GDP in 2025. This is higher than Mexico and Colombia. Families in Belize are therefore sensitive to any shift in US labor or economic policy.

The IDB estimates that households receiving remittances saw income improvements of 17.7% more than households without such support.

Belize also experienced only a small loss in purchasing power due to inflation. This kept remittances effective in covering essential expenses.

Remittances to Central American Countries (2025) by IDB Migration Unit

How is the region performing overall?

According to IDB, remittances are forecast to grow by 7.2% across LAC. This would reverse the slowdown seen in 2024 and enforce the steady increase for sixteen consecutive years.

The report links the increase to uncertainty in the United States. Migrants reacted to these conditions by adjusting their financial behaviour.

“The response of migrants to some changes in the migration policies of host countries—along with discussions like the remittance tax in the US—partly explains the overall growth trend: initially, migrants used their savings to make extraordinary remittances (a 9.9% increase regionally in the first quarter),” and later “increased working hours to generate higher income,” IDB reported.

“These flows have demonstrated resilience amid economic, social, and political transformations not only in the region but worldwide,” it added.

This period aligned with major political changes in the US after President Donald Trump took office a second time. The new administration introduced spending cuts and policy adjustments that created economic pressure and insecurity.

Effect of Exchange Rate and Inflation on Remittances (2024-2025) by IDB Migration Unit

What is the bottom line?

Remittances continue to help millions stay out of poverty. The report states that “our million people across the seven analysed countries move from extreme poverty to relative poverty or reach income levels above the poverty line” because of remittances.

However, those in extreme poverty receive less support because migration is often too costly for them.

The IDB concludes that remittances are resilient but not unlimited. Migration flows could slow. Barriers to sending money could rise. If that happens, household incomes across the region would be at risk of feeling immediate effects.

Facebook Comments